Income Statement

ACFID Compliance

Australian Red Cross is a signatory to the Australian Council for International Aid and Development (ACFID) Code of Conduct and is committed to full adherence to its requirements. The Code aims to improve international development outcomes and increase stakeholder trust by enhancing the transparency and accountability of signatory organisations.

The ACFID Code of Conduct offers a mechanism to address concerns relating to signatories’ conduct. Complaints against Australian Red Cross may be initiated by any member of the public and lodged with the ACFID Code of Conduct Committee at acfid.asn.au/code-of-conduct/complaints or for further information on the ACFID Code please see ACFID website acfid.asn.au.

As a signatory, Australian Red Cross is required to publish the complete set of ACFID financial statements according to their prescribed format and standards. These are available at redcross.org.au/files/Financials_2014.pdf. Alternatively, call the Supporter Services Centre on 1800 811 700 to request a printed copy. For further information on the Code’s requirements, please refer to the ACFID Code of Conduct Implementation Guidance available at acfid.asn.au.

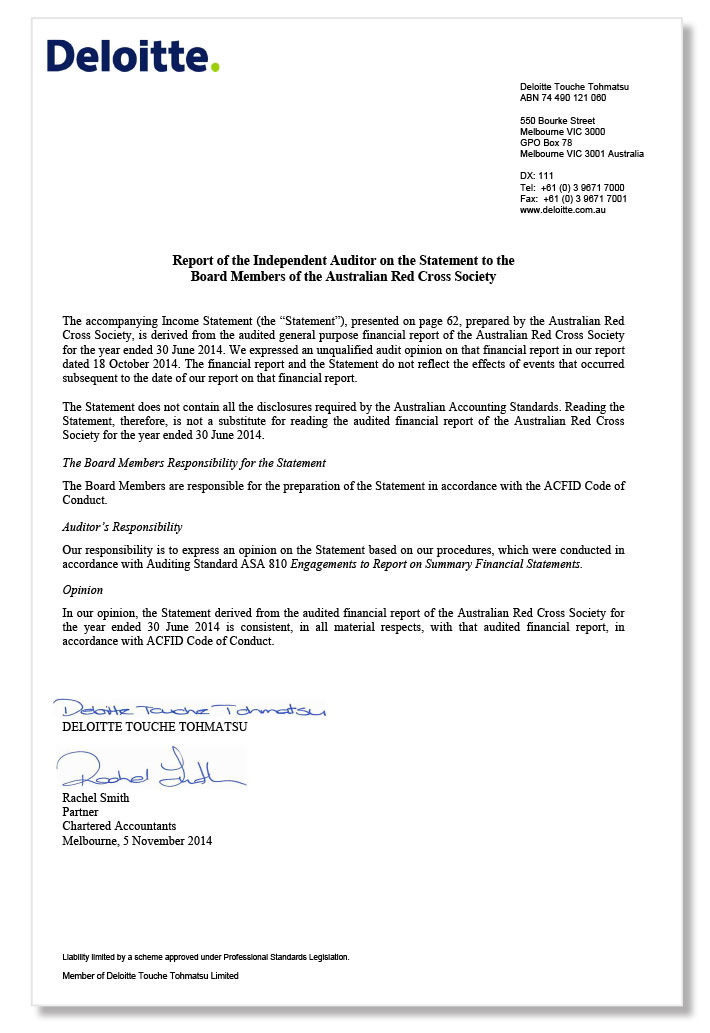

Income Statement for the financial year ended 30 June 2014

The Income Statement discloses the revenue and expenses during the financial year ending 30 June 2014.

|

HUMANITARIAN SERVICES |

SOCIETY |

HUMANITARIAN SERVICES |

SOCIETY |

||

|

2014 |

2014 |

2013 |

2013 |

||

|

$'000 |

$'000 |

$'000 (restated) |

$’000 (restated) |

||

|

REVENUE |

|||||

|

Donations and gifts1 |

82,131 |

82,131 |

79,046 |

79,046 |

|

|

Legacies and bequests2 |

15,507 |

15,507 |

16,720 |

16,720 |

|

|

Grants |

|||||

|

• Department of Foreign Affairs and Trade |

22,789 |

22,789 |

23,907 |

23,907 |

|

|

• other Australian |

354,873 |

915,978 |

280,142 |

836,683 |

|

|

• other overseas |

3,276 |

3,276 |

3,404 |

3,404 |

|

|

Investment income |

4,771 |

12,879 |

6,955 |

15,134 |

|

|

Other income3 |

43,536 |

56,123 |

39,029 |

48,896 |

|

|

Total revenue |

526,883 |

1,108,683 |

449,203 |

1,023,790 |

|

|

EXPENDITURE |

|||||

|

International Aid and Development Programs expenditure |

|||||

|

• funds to international programs |

37,276 |

37,276 |

30,268 |

30,268 |

|

|

• program support costs |

4,329 |

4,329 |

4,076 |

4,076 |

|

|

• community education |

1,147 |

1,147 |

1,001 |

1,001 |

|

|

Domestic programs |

370,076 |

925,973 |

329,027 |

889,639 |

|

|

• Blood Service |

- |

555,897 |

- |

560,612 |

|

|

• Migration Support |

280,930 |

280,930 |

207,109 |

207,109 |

|

|

• Social Inclusion |

35,425 |

35,425 |

18,022 |

18,022 |

|

|

• Location disadvantage |

32,143 |

32,143 |

16,950 |

16,950 |

|

|

• Disaster and emergency services |

10,454 |

10,454 |

10,106 |

10,106 |

|

|

• Aboriginal & Torres Straight Islander Programs |

7,218 |

7,218 |

6,901 |

6,901 |

|

|

• Emergency Appeals |

3,780 |

3,780 |

14,630 |

14,630 |

|

|

• Other |

126 |

126 |

55,309 |

55,309 |

|

|

Fundraising costs4 |

|||||

|

• public, government, multilateral and private |

27,043 |

27,043 |

15,864 |

15,864 |

|

|

Retail and Commercial activities |

42,708 |

42,708 |

46,052 |

46,052 |

|

|

Accountability and Administration5 |

42,169 |

42,169 |

23,265 |

23,265 |

|

|

Total expenditure |

524,748 |

1,080,645 |

449,553 |

1,010,165 |

|

|

Excess of revenue over expenditure from continuing operations |

2,135 |

28,038 |

(350) |

13,625 |

|

|

This Income Statement conforms with the ACFID prescribed format and standards and should be read in conjunction with the other components of the ACFID Financial Statements, as well as the Financial Statements and accompanying notes on pages 6-44 of the full Financial Report available at redcross.org.au/files/Financials_2014.pdf. 1 During the financial year nil (2013: $603,000) was recorded as non-monetary donations and gifts. In addition to those goods which are capable of reliable measurement, the organisation has received donated goods for sale in its retail outlets as well as volunteer hours in providing community services. Significant contributions are also received by way of gifts in kind as pro bono support from corporate partners and volunteers. These goods and services are of a nature for which fair value cannot be reasonably determined and have not been recorded in this income statement. There has been no non monetary expenditure included in the income statement. 2 Legacies and bequests generated an additional $85,000, recorded as Investment Income in the above income statement. In the financial statements this income is classified as investment income. 3 Other income includes revenue from retail activities and training services. 4 Fundraising costs include both International and Domestic programs. There have been no costs incurred for Government, multilateral and private fundraising costs. 5 Accountability, administration and marketing costs include both International and Domestic programs. During the financial year there were no transactions (2013:nil) in the International Political or Religious Adherence Promotion program category. |

|||||

Let us know what you think

Any feedback or complaints about Red Cross or its work can be made at redcross.org.au or by calling 1800 811 700. Red Cross invites any feedback you may have regarding the Year in Review 2013/2014. Contact the editorial team at publications@redcross.org.au